- The Wealth Consciousness Report

- Posts

- Golden Savings: A Unique Approach to Investing and Saving with a Compound Twist.

Golden Savings: A Unique Approach to Investing and Saving with a Compound Twist.

In today's volatile financial landscape, finding reliable and efficient ways to save and invest is more crucial than ever. While traditional savings accounts and investment portfolios offer certain advantages, I've discovered a unique approach that leverages the power of gold and the magic of compound interest.

How it Works

Every paycheck, I dedicate 35% to purchasing physical gold – coins, small bars, you name it. This act of disciplined saving creates a tangible asset that can be used as a store of value and a hedge against inflation.

Leveraging Gold for Investment Opportunities

When a promising investment opportunity arises, I utilize my gold holdings. Instead of selling them outright, I opt to pawn them. This essentially involves using my gold as collateral to secure a short-term loan.

The advantage of this strategy lies in the exceptionally low interest rate. Pawn shops typically offer rates as low as 5% annually. This means that any investment I make using these funds only needs to outperform that 5% to be profitable.

The Compound Interest Twist

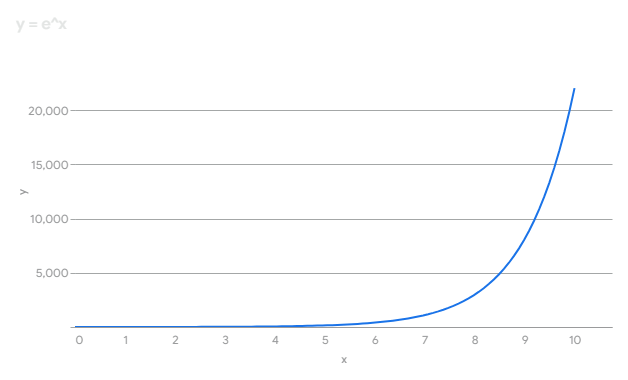

Here's where my strategy takes an interesting turn. When I realize profits from an investment funded by pawning my gold, I reinvest 50% of those profits back into buying more gold. This creates a compounding effect, where my gold savings grow exponentially over time.

Think of it like a snowball rolling downhill, gathering more snow and momentum as it goes. This approach allows me to not only save consistently but also accelerate the growth of my gold holdings.

Pros and Cons

Pros:

Forced Savings: The tangible nature of gold discourages impulsive spending, encouraging disciplined savings.

Inflation Hedge: Gold has historically proven to be a reliable hedge against inflation, preserving wealth over time.

Portfolio Diversification: Adding gold to your investment portfolio can reduce overall risk and enhance returns.

Low-Interest Leverage: Pawning gold provides access to funds at a minimal cost.

Compound Growth: Reinvesting profits back into gold accelerates the growth of your holdings.

Cons:

Liquidity: Gold is not as liquid as cash, making it less suitable for immediate needs.

Price Fluctuations: The price of gold can fluctuate, impacting its value.

Storage and Security: Storing physical gold requires careful consideration and potentially additional costs.

Important Considerations

Before adopting this strategy, it's crucial to conduct thorough research and consider the following:

Reputable Dealers and Pawn Shops: Choose reliable and trustworthy dealers and pawn shops.

Market Value of Gold: Stay informed about current gold prices and potential fluctuations.

Fees and Interest Charges: Understand the associated fees and interest rates.

Emergency Fund: Maintain a separate emergency fund to cover unexpected expenses.

By carefully considering these factors, you can effectively implement this strategy to achieve your financial goals.

Remember: This approach is not a one-size-fits-all solution. It's essential to assess your individual financial situation and risk tolerance before making any investment decisions.