- The Wealth Consciousness Report

- Posts

- Mastering Stock Options: An In-Depth Guide for Wealth-Conscious Investors.

Mastering Stock Options: An In-Depth Guide for Wealth-Conscious Investors.

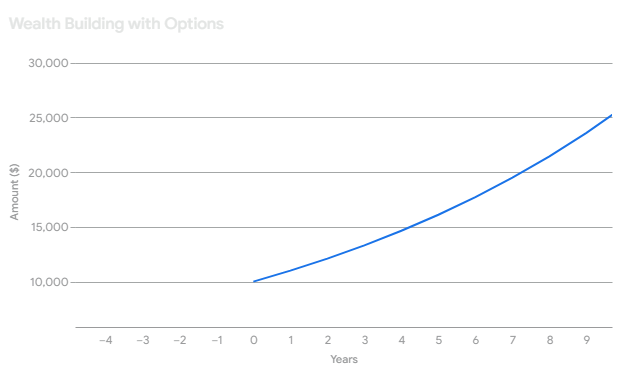

Stock options can seem intimidating, but they hold immense potential for those who dare to understand them. This edition of the Wealth Consciousness Report is your comprehensive guide to navigating the world of options, empowering you to make informed decisions and unlock new opportunities for wealth creation.

Unveiling the World of Stock Options.

Imagine having the power to control 100 shares of a company like Apple or Tesla with a fraction of the cost of actually owning those shares. That's the allure of stock options. They are contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) 100 shares of a specific stock at a predetermined price (strike price) on or before a specific date (expiration date).

Key Components of a Stock Option:

Underlying Asset: The stock that the option is based on (e.g., Apple, Tesla, Google).

Call Option: Grants the right to buy 100 shares of the underlying asset at the strike price.

Put Option: Grants the right to sell 100 shares of the underlying asset at the strike price.

Strike Price: The predetermined price at which you can buy or sell the underlying asset.

Expiration Date: The deadline for exercising your option.

Premium: The price you pay to purchase an option contract.

How Options Work:

Let's illustrate with an example. Suppose you believe that Amazon stock (currently trading at $100) will rise above $120 in the next two months. You could buy a call option with a strike price of $120 and an expiration date two months out. If Amazon's price climbs to $130 before expiration, you can exercise your option to buy 100 shares at $120, then immediately sell them at the market price of $130, making a profit.

Conversely, if you anticipate Amazon stock will decline below $90, you could buy a put option with a strike price of $90. If the price drops to $80, you can exercise your option to sell 100 shares at $90, even though the market price is lower.

Are Stock Options Your Path to Wealth?

Stock options are not for everyone. They are derivative securities, meaning their value is derived from the underlying asset. This introduces complexity and risk.

Consider these factors before diving into options trading:

Market Knowledge: A solid understanding of the stock market, including factors influencing stock prices (e.g., company performance, economic conditions, industry trends), is crucial.

Risk Tolerance: Options can be highly volatile, and there's a real possibility of losing your entire investment. Only invest what you can afford to lose.

Investment Strategy: Options can be used for various strategies, including:

Hedging: Protecting existing stock holdings from potential losses.

Income Generation: Selling covered call options on stocks you already own to generate income.

Speculation: Betting on the direction of a stock's price movement.

Time Commitment: Options trading requires active monitoring and management.

The cost of an option (the premium) is influenced by several factors:

Underlying Asset Price: Options on higher-priced stocks typically have higher premiums.

Volatility: Options on volatile stocks are generally more expensive due to the increased potential for price swings.

Time to Expiration: Longer-term options have higher premiums because there's more time for the stock price to move in your favor.

Intrinsic Value: The difference between the current stock price and the strike price.

Time Value: The potential for the option to gain value before expiration.

Remember: Each option contract represents 100 shares of the underlying stock.

Understanding the Risks: A Comprehensive Overview

Options trading involves significant risks, including:

Time Decay: The value of options erodes as they approach expiration, especially for out-of-the-money options.

Volatility: Option prices can fluctuate dramatically, potentially leading to significant losses.

Limited Lifespan: Options have an expiration date, after which they become worthless if not exercised.

Leverage: Options provide leverage, meaning you can control a large number of shares with a relatively small investment. However, leverage can magnify both profits and losses.

Unraveling the Greeks: Decoding Option Behavior

The "Greeks" are a set of risk measures that help options traders understand and manage the various factors that influence option prices.

Delta: Measures how much an option's price is expected to change for every $1 change in the underlying asset's price.

Gamma: Measures how much delta is expected to change for every $1 change in the underlying asset's price.

Theta: Measures the rate of time decay of an option's value.

Vega: Measures how much an option's price is expected to change for every 1% change in the implied volatility of the underlying asset.

Rho: Measures how much an option's price is expected to change for every 1% change in the risk-free interest rate.

Understanding the Greeks can help you assess and manage the risks associated with options trading.

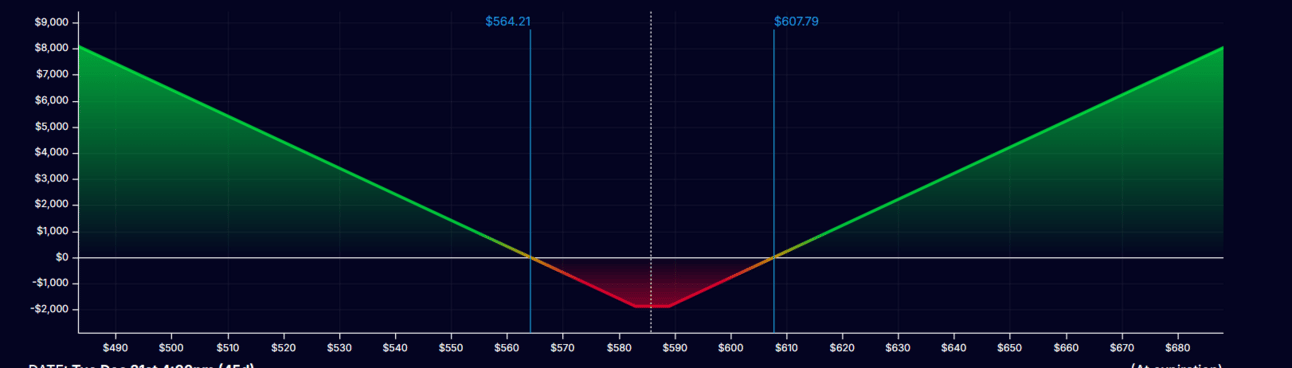

Straddles: A Strategy for Volatility

A "straddle" is an options strategy that involves simultaneously buying both a call option and a put option on the same underlying stock with the same strike price and expiration date. This strategy is employed when an investor anticipates a significant price move in the stock but is unsure of the direction.

Why use a straddle?

High Volatility Expected: Straddles are best suited for situations where you expect a major price swing, but the direction is uncertain. This could be due to events like earnings announcements, product launches, or regulatory decisions.

Profiting from Uncertainty: If the stock price moves significantly in either direction, one of your options will likely be profitable, potentially offsetting any losses on the other option.

How it works:

Upward Price Movement: If the stock price rises substantially above the strike price, your call option will gain value, potentially exceeding the losses on the put option.

Downward Price Movement: If the stock price falls significantly below the strike price, your put option will gain value, potentially exceeding the losses on the call option.

Limited Price Movement: If the stock price remains relatively stable, both options may lose value due to time decay, potentially resulting in a loss.

Important considerations:

Higher Upfront Costs: Straddles involve higher initial costs because you're purchasing two options contracts.

Break-Even Points: To profit from a straddle, the stock price needs to move significantly enough in either direction to cover the combined premiums paid for both options.

Conclusion

/

Stock options offer a unique and potentially lucrative avenue for wealth creation, but they demand a thorough understanding of the risks and complexities involved. Before venturing into options trading, educate yourself, assess your risk tolerance, and consider seeking guidance from a financial professional.

Eager to explore more wealth-building strategies and unlock your financial potential? Visit thewealthconsciousnessreport.beehiiv.com for valuable resources and tools to empower your financial journey.