- The Wealth Consciousness Report

- Posts

- The Snowball Effect: How Compound Interest Can Make You Rich (Even While You Sleep)

The Snowball Effect: How Compound Interest Can Make You Rich (Even While You Sleep)

Imagine a snowball rolling down a hill. It starts small, but as it gathers more snow, it grows larger and larger, picking up speed and momentum. That's the magic of compound interest – it's like a financial snowball that can turn even small amounts of money into a massive fortune over time.

What is this Magical Compound Interest?

Simply put, compound interest is interest earned on interest. It's like getting paid, not just for your initial investment, but also for the accumulated interest from previous periods. This creates a powerful cycle of growth that accelerates your wealth over time.

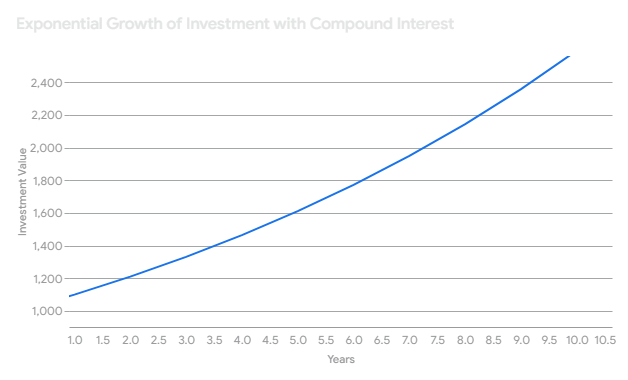

Think of it like this: you invest $1,000 and earn 10% interest in the first year, giving you $100 in interest. In the second year, you earn interest not just on your initial $1,000, but on $1,100 (your original investment plus the interest). This means you'll earn $110 in interest in the second year. As this process repeats, your money grows exponentially.

Compound Interest in Action: Investing

Compound interest is the secret weapon of successful investors. Here's how it works in various investment scenarios:

Stocks: When you reinvest dividends from stocks, you're essentially using compound interest to grow your investment. Those dividends buy more shares, which generate more dividends, and so on.

Bonds: Similar to stocks, reinvesting interest payments from bonds allows you to benefit from compounding.

Savings accounts: Even with modest interest rates, the power of compounding can significantly grow your savings over the long term.

Real Estate: Rental income can be reinvested to purchase more properties, creating a compounding effect on your real estate portfolio.

Beyond Investing: Compounding in Daily Life

The principles of compound interest can be applied beyond just financial investments. Here are some examples:

Skills and Knowledge: The more you learn and practice a skill, the better you become. This improvement compounds over time, leading to mastery and greater opportunities.

Relationships: Investing time and effort in building strong relationships yields compound returns in the form of support, collaboration, and happiness.

Health: Consistent healthy habits, like exercise and good nutrition, compound over time to improve your overall well-being and longevity.

The Rule of 72: A Quick Compounding Calculation

Want to know how long it takes to double your money with compound interest? Use the Rule of 72! Divide 72 by the interest rate to get an approximate number of years. For example, at a 7% interest rate, it would take roughly 10 years to double your money.

Conclusion: Start Early, Stay Consistent

The sooner you start investing and harnessing the power of compound interest, the greater your potential for wealth creation. Even small, consistent contributions can grow exponentially over time. So, start today, stay disciplined, and watch your financial snowball grow into an avalanche of wealth!